Silvercorp Reports Adjusted Net Income Of $22.0 Million, $0.10 Per Share, And Cash Flow from Operations Of $44.8 Million For Q3 Fiscal 2025

Trading Symbols: TSX/NYSE AMERICAN: SVM

VANCOUVER, British Columbia – February 11, 2025 – Silvercorp Metals Inc. (“Silvercorp” or the “Company”) (TSX/NYSE American: SVM) reported its financial and operating results for the three months ended December 31, 2024 (“Q3 Fiscal 2025”). All amounts are expressed in US dollars, and figures may not add due to rounding.

HIGHLIGHTS FOR Q3 FISCAL 2025

- Mined 383,543 tonnes of ore, milled 361,810 tonnes of ore, and produced approximately 2,056 ounces of gold, 1.9 million ounces of silver, or approximately 2.1 million ounces of silver equivalent[1], plus 17.1 million pounds of lead and 6.7 million pounds of zinc;

- Sold approximately 1,875 ounces of gold, 2.0 million ounces of silver, 17.1 million pounds of lead, and 6.6 million pounds of zinc, for revenue of $83.6 million;

- Net income attributable to equity shareholders of $26.1 million, or $0.12 per share;

- Excluding $11.6 million gain on fair value of derivative liabilities, less $8.9 million one-time non-routine mineral right transfer royalty payment for renewing SGX mining license, and other minor items, the adjusted net income attributable to equity shareholders1 of $22.0 million, or $0.10 per share;

- Generated cash flow from operating activities of $44.8 million;

- Cash cost per ounce of silver, net of by-product credits1, of negative $1.88;

- All-in sustaining cost per ounce of silver, net of by-product credits1, of $12.75;

- Spent and capitalized $17.8 million on underground exploration and development, and $7.5 million on equipment and facilities for the No. 3 tailings storage facility and the new 1,500 tonne per day mill at the Ying Mining District;

- Spent and capitalized $2.1 million at the El Domo and Condor Projects;

- Repaid $13.25 million to Wheaton Precious Metals International Ltd. (Wheaton") to eliminate obligations to deliver 92.3 ounces of gold per month to Wheaton for the El Domo Project;

- Spent $3.7 million on dividends to the shareholders of the Company and on share buyback;

- Existing cash of $211.1 million plus $143.3 million net proceeds raised through an issuance of unsecured convertible senior notes nets the Company with $354.6 million in cash and cash equivalents and short-term investments; the Company also has a stream arrangement to access up to $175.0 million to fund the El Domo project construction, and holds a portfolio of equity investment in associates and other companies with a total market value of $68.9 million as at December 31, 2024; and,

- Awarded the first construction contract of the El Domo Project using "Unit Cost" criteria.

[1] Non-IFRS measures, please refer to section 13 of the corresponding MD&A for the three and nine months ended December 31, 2024 for reconciliation.

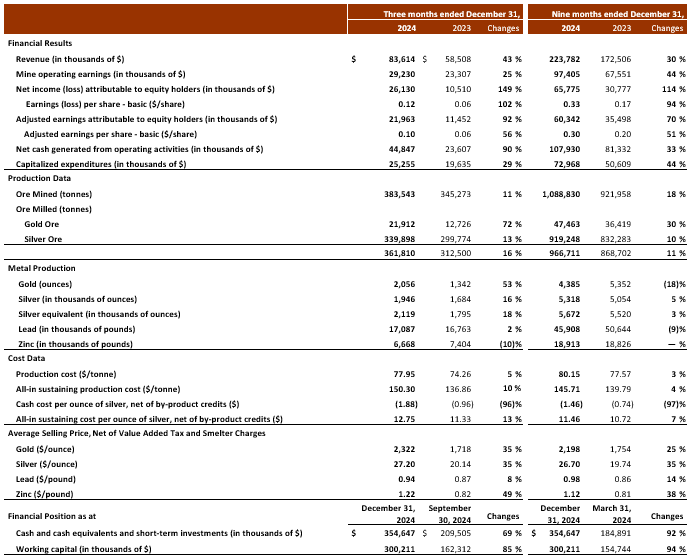

CONSOLIDATED FINANCIAL RESULTS

Net income attributable to equity shareholders of the Company in Q3 Fiscal 2025 was $26.1 million or $0.12 per share, compared to net income of $10.5 million or $0.06 per share in the three months ended December 31, 2023 ("Q3 Fiscal 2024").

Compared to Q3 Fiscal 2024, the Company’s consolidated financial results were mainly impacted by i) increases of 35%, 35%, 8% and 49%, respectively, in the realized selling prices for gold, silver, lead and zinc; ii) increases of 40%, 15% and 5%, respectively, in gold, silver and lead sold; iii) a $11.6 million gain on the fair value of derivative liabilities; iv) a decrease of $5.3 million in share of loss in associates, offset by v) a decrease of 10% in zinc sold; vi) an increase of 11.9 million in government fees and other taxes, vii) a decrease of $4.7 million in gain on investments, and viii) an increase of $2.2 million in mine and corporate administrative expenses.

Excluding $11.6 million gain on fair value of derivative liabilities, less $8.9 million one-time non-routine mineral right transfer royalty payment for renewing SGX mining license, and other minor items, the adjusted net income attributable to equity shareholders was $22.0 million or $0.10 per share compared to $11.5 million or $0.06 per share in Q3 Fiscal 2024.

Revenue in Q3 Fiscal 2025 was $83.6 million, up 43% compared to $58.5 million in Q3 Fiscal 2024. The increase is mainly due to an increase of $16.8 million arising from the increase in the realized selling prices and an increase of $8.7 million arising from the increase of gold, silver and lead sold, offset by a decrease of $0.9 million as a result of less zinc sold.

Income from mine operations in Q3 Fiscal 2025 was $29.2 million, up 25% compared to $23.3 million in Q3 Fiscal 2024. The increase was mainly due to the increase in revenue arising from the increases in the net realized metal selling prices and more metals sold. Income from mine operations at the Ying Mining District was $25.4 million, compared to $21.5 million in Q3 Fiscal 2024. Income from mine operations at the GC Mine was $4.4 million, compared to $1.9 million in Q3 Fiscal 2024.

Cash flow provided by operating activities in Q3 Fiscal 2025 was $44.8 million, up $21.2 million, compared to $23.6 million in Q3 Fiscal 2024. The increase was due to:

- $34.8 million cash flow from operations before changes in non-cash operating working capital, up $11.0 million compared to $23.7 million in Q3 Fiscal 2024; and

- $10 million cash from changes in non-cash working capital, compared to $0.1 million provided in Q3 Fiscal 2024.

The Company ended the quarter with cash, cash equivalents and short term investments of $354.6 million, up 92% or $169.8 million compared to $184.9 million as at March 31, 2024, and up 69% or $145.1 million compared to $209.5 million as at September 30, 2024. The Company holds a further equity investment portfolio in associates and other companies with a total market value of $68.9 million as at December 31, 2024.

CONSOLIDATED OPERATIONAL RESULTS

In Q3 Fiscal 2025, on a consolidated basis, the Company mined 383,543 tonnes of ore, up 11% compared to 345,273 tonnes in Q3 Fiscal 2024. Ore milled was 361,810 tonnes, up 16% compared to 312,500 tonnes in Q3 Fiscal 2024.

In Q3 Fiscal 2025, the Company produced approximately 2,056 ounces of gold, 1.9 million ounces of silver, or approximately 2.1 million ounces of silver equivalent, plus 17.1 million pounds of lead and 6.7 million pounds of zinc, representing increases of 53%, 16%, 18%and 2% in gold, silver, silver equivalent, and lead, and a decrease of 10% in zinc over Q3 Fiscal 2024. The increase is mainly due to the increase in ore production offset by lower lead and zinc head grades achieved.

In Q3 Fiscal 2025, the consolidated mining costs were $63.82 per tonne, up 7% compared to $59.43 per tonne in Q3 Fiscal 2024. The increase was mainly due to more mining preparation tunnels and grade control drilling completed and expensed as part of the mining costs in the current quarter. The consolidated milling costs were $11.61 per tonne, down 7% compared to $12.44 per tonne in Q3 Fiscal 2024. Correspondingly, the consolidated production costs per tonne of ore processed were $77.95 per tonne, up 5% compared to $74.26 per tonne in Q3 Fiscal 2024, while the all-in sustaining production costs per tonne of ore processed were $150.30 per tonne, up 10% compared to $136.86 per tonne in Q3 Fiscal 2024. The increase was mainly due to an increase of 5% in the production costs per tonne and an increase of 3% in the sustaining capital expenditures per tonne.

In Q3 Fiscal 2025, the consolidated cash costs per ounce of silver, net of by-product credits, were negative $1.88, compared to negative $0.96 in Q3 Fiscal 2024. The decrease was mainly due to an increase of $6.3 million in by-product credits partially offset by the 5% increase in production costs per tonne. The consolidated all-in sustaining costs per ounce of silver, net of by-product credits, were $12.75, up 13% compared to $11.33 in Q3 Fiscal 2024. The increase was mainly due to an increase of $6.4 million in general administrative expenses, sustaining capital expenditures, and mineral resources tax, as well as government fees and other taxes offset by the decrease in the cash costs per ounces of silver, net of by-product credits as discussed above.

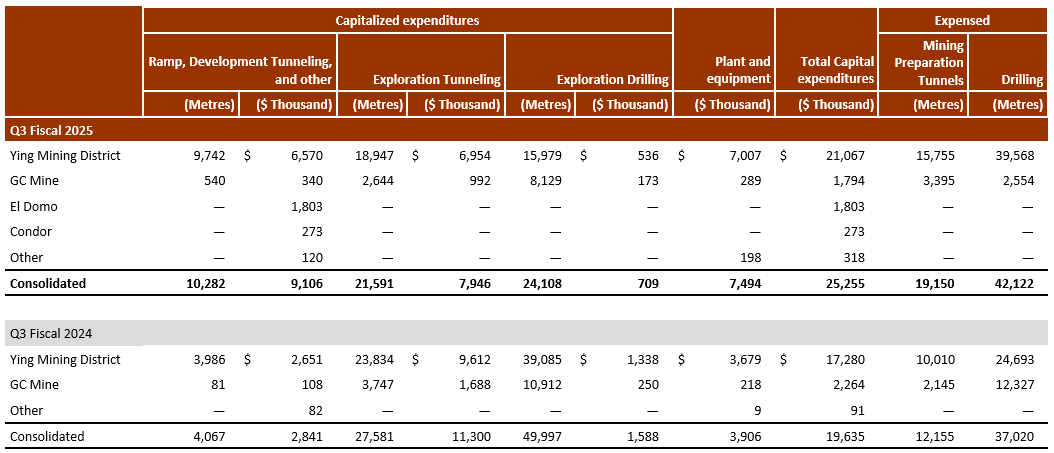

EXPLORATION AND DEVELOPMENT

Total capital expenditures in Q3 Fiscal 2025 were $25.3 million, up 29% compared to $19.6 million in Q3 Fiscal 2024. The increase was mainly due to more tunneling completed and the construction of the No. 3 tailings storage facility ("TSF") and mill expansion at the Ying Mining District, as well as additional expenditures incurred at the newly acquired El Domo Project and Condor Project. The construction of the Phase 1 of the TSF and mill expansion at the Ying Mining District were completed in Q3 Fiscal 2025 on time and under budget.

As announced in the Company's news release dated January 7, 2025, the Company has made substantial progress in advancing the construction of the El Domo Project, including awarding the first major commercial contract to CCRC 14 Bureau Group Co. Ltd. ("CCRC14"). Total expenditures incurred and capitalized at the El Domo Project were $1.8 million in the current quarter, and $4.3 million since the acquisition.

At the Condor Project, the Company has been diligently working to reorganize the Condor operational structure, conduct a mineral resource review to assess future development plans, and initiate site control activities. Total capital expenditures incurred and capitalized at the Condor project were $0.3 million in the current quarter and $0.8 million since the acquisition.

In Q3 Fiscal 2025, on a consolidated basis, a total of 66,230 metres or $2.0 million worth of diamond drilling were completed (Q3 Fiscal 2024 – 87,017 metres or $2.4 million), of which approximately 42,122 metres or $1.4 million worth were expensed as part of mining costs (Q3 Fiscal 2024 – 37,020 metres or $0.7 million) and approximately 24,108 metres or $0.6 million worth were capitalized (Q3 Fiscal 2024 – 49,997 metres or $1.6 million). In addition, approximately 19,150 metres or $5.0 million worth of preparation tunneling were completed and expensed as part of mining costs (Q3 Fiscal 2024 – 12,155 metres or $4.5 million), and approximately 31,873 metres or $14.9 million worth of tunnels, raises, ramps and declines were completed and capitalized (Q3 Fiscal 2024 – 31,648 metres or $14.1 million).

The Kuanping Project has received all required permits and licenses and is now ready for construction.

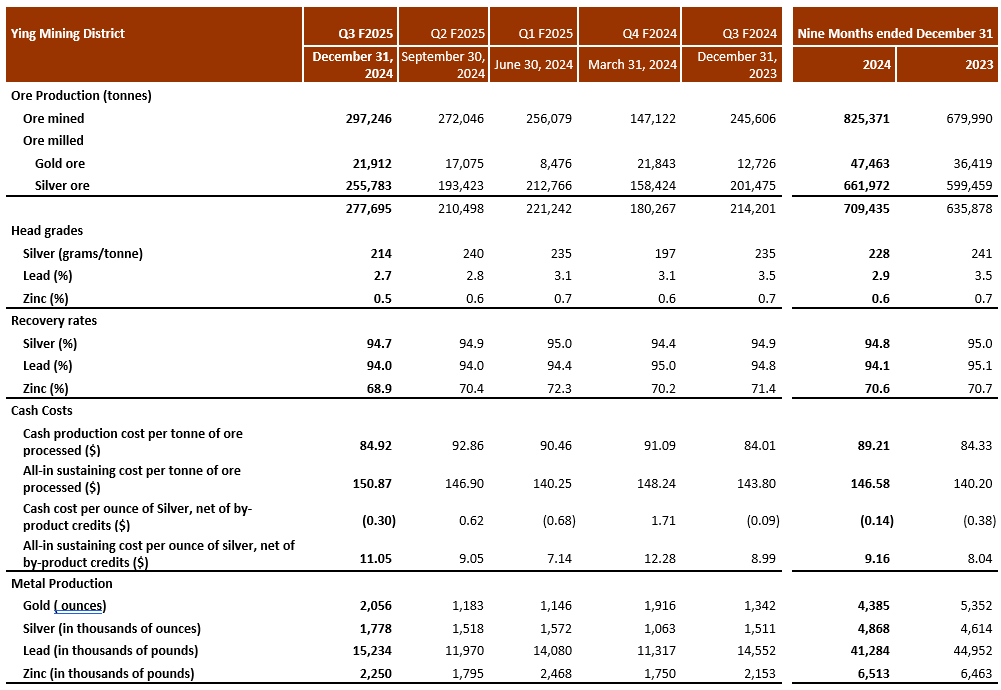

INDIVIDUAL MINE OPERATING PERFORMANCE

In Q3 Fiscal 2025, a total of 297,246 tonnes of ore were mined at the Ying Mining District, up 21% compared to 245,606 tonnes in Q3 Fiscal 2024, and 277,695 tonnes of ore were milled, up 30% compared to 214,201 tonnes in Q3 Fiscal 2024.

Average head grades of ore processed were 214 g/t for silver, 2.7% for lead, and 0.5% for zinc compared to 235 g/t for silver, 3.5% for lead, and 0.7% for zinc in Q3 Fiscal 2024.

Metals produced at the Ying Mining District were approximately 2,056 ounces of gold, 1.8 million ounces of silver, or approximately 2.0 million ounces of silver equivalent, plus 15.2 million pounds of lead, and 2.3 million pounds of zinc, representing production increases of 53%, 18%, 20%, 5%, and 5%, in gold, silver, silver equivalent, lead and zinc, respectively, compared to 1,342 ounces of gold, 1.5 million ounces of silver, or approximately 1.6 million silver equivalent, plus 14.6 million pounds of lead, and 2.2 million pounds of zinc in Q3 Fiscal 2024. The increase was mainly due to the increase in ore production, partially offset by lower head grades achieved. Inventory stockpile ores of approximately 145 thousand tonnes as at December 31, 2024 are being processed during the Chinese New Year holidays in the fourth quarter of Fiscal 2025.

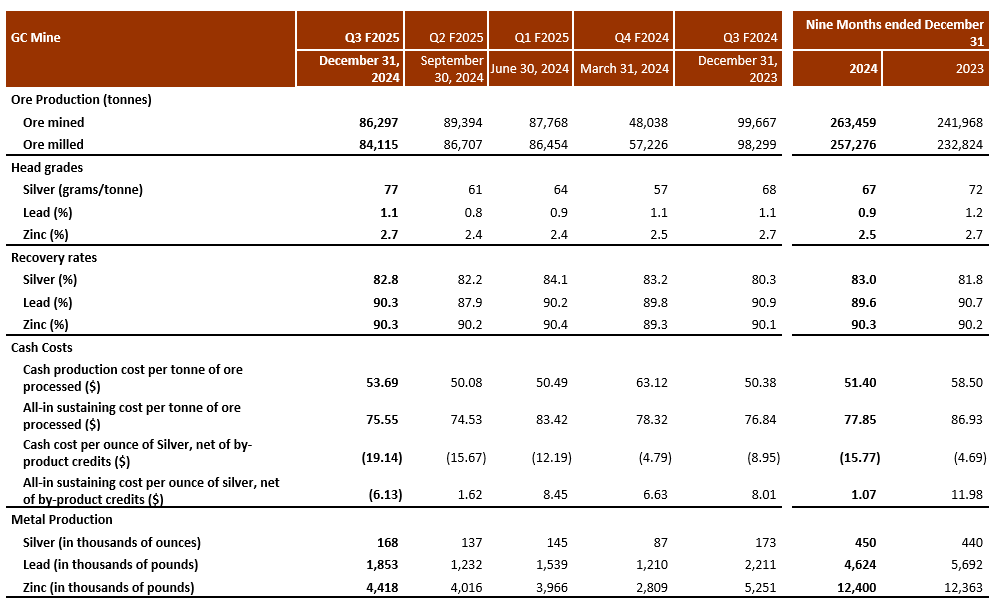

In Q3 Fiscal 2025, a total of 86,297 tonnes of ore were mined at the GC Mine, down 13% compared to 99,667 tonnes in Q3 Fiscal 2024, while 84,115 tonnes were milled, down 14% compared to 98,299 tonnes in Q3 Fiscal 2024.

In Q3 Fiscal 2025, approximately 14,300 tonnes of waste were removed through the XRT Ore Sorting System.

Average head grades of ore milled were 77 g/t for silver, 1.1% for lead, and 2.7% for zinc compared to 68 g/t for silver, 1.1% for lead, and 2.7% for zinc in Q3 Fiscal 2024.

Metals produced at the GC Mine were approximately 168 thousand ounces of silver, 1.9 million pounds of lead, and 4.4 million pounds of zinc, representing decreases of 3%, 16%, and 16%, in silver, lead and zinc production, respectively, compared to 173 thousand ounces of silver, 2.2 million pounds of lead, and 5.3 million pounds of zinc in Q3 Fiscal 2024.

OPERATING OUTLOOK

Pending the detailed engineering design of the process plant of the El Domo Project, the Company expects to provide Fiscal 2026 production and capital expenditures along with the release of Fiscal 2025 production results in April 2025.

CONFERENCE CALL DETAILS

A conference call to discuss these results will be held on February 13, Thursday, at 9:00 am PDT (12:00 pm EDT). To participate in the conference call, please dial the numbers below.

Canada/USA TF: 888-510-2154

International/Local Toll: 437-900-0527

Conference ID: 99469

Participants should dial-in 10 – 15 minutes prior to the start time. A replay of the conference call and transcript will be available on the Company’s website at www.silvercorpmetals.com.

Mr. Guoliang Ma, P.Geo., Manager of Exploration and Resources of the Company, is the Qualified Person as defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) and has reviewed and given consent to the technical information contained in this news release.